Maple Rock Reserve

A private investment opportunity for accredited investors seeking passive income, tax efficiency, and proven risk management.

Maple Rock Reserve is our latest multifamily real estate investment opportunity created to generate growth, income and tax efficiency for accredited investors.

Located in Sioux Falls, South Dakota, this 164-unit development will capitalize on the region’s stellar economy: higher-than-average personal incomes, low unemployment and rapid growth. Combined with Boardwalk’s quick-lease construction model, unique risk management framework, and discounted finance terms, early investor demand is high.

Act now and reserve your spot today.

Full Entitled, Shovel-Ready, In Highest Rent Zip Code

This is “ready to build” land in a Class A location in Lincoln County (57108 — highest rent zip code in South Dakota) with very limited competing multifamily product.

- $90,548 median income

- Harrisburg school district (fastest growing in the Midwest)

- Major Intersection nearby, gives access to the entire eastern and southern portions of the largest metro area in South Dakota

- Second largest shopping area nearby, along with premier new wellness facility

Development Model Reduces Risk & Increases Favorable Financing

This “No Frills” project is a series of eleven 12-plex buildings. By excluding traditional amenities like a gym and underground parking, we build faster, and then lease up as each building is completed.

- Quicker lease-up means faster cash flows

- Faster cash flows mean better finance and refinance options

- “No Frills” approach nets rents slightly under premium competitors but with greatly reduced construction time and cost (due to market demand and careful area selection)

True KHANservative Underwriting To Bolster Your Upside

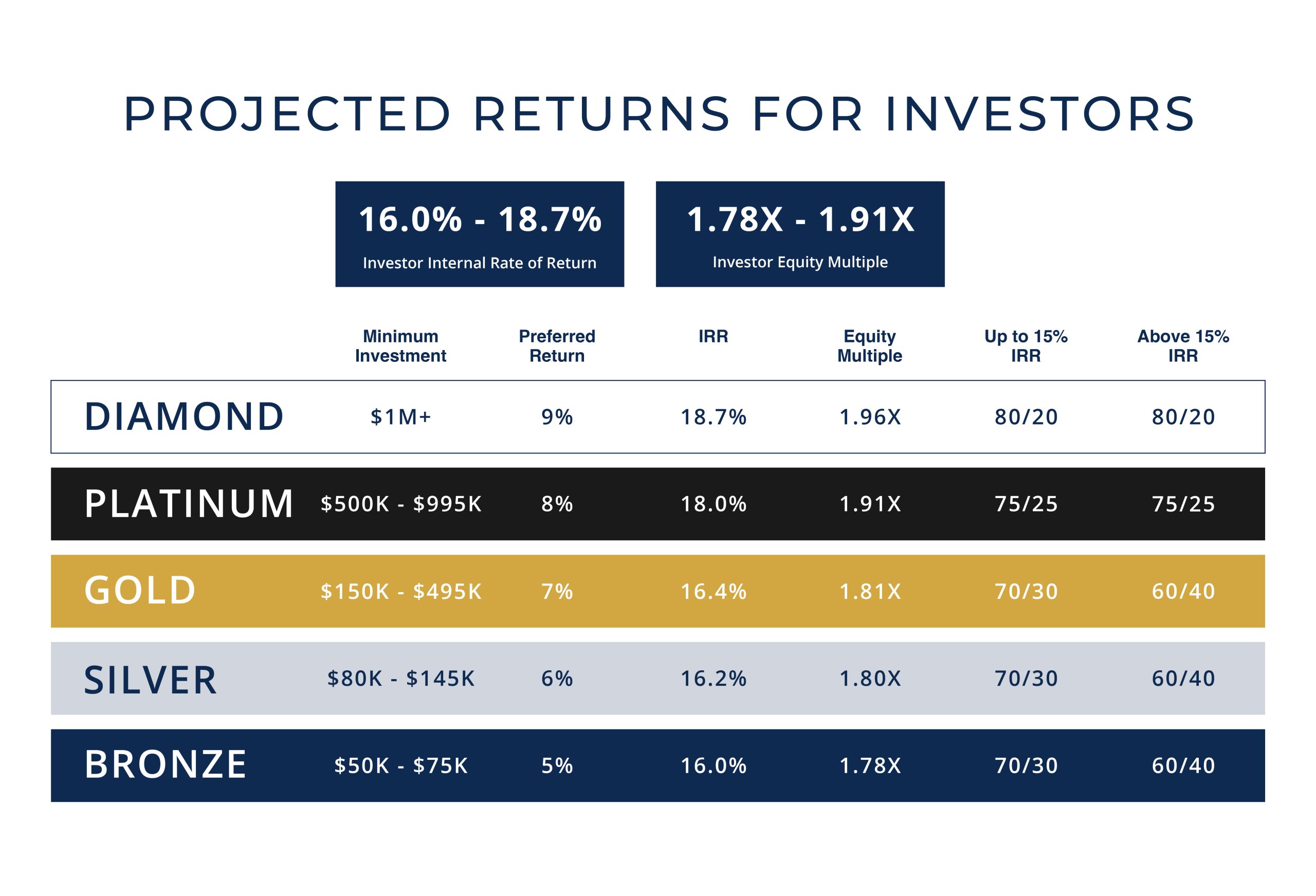

The projected returns deliberately exclude certain expected results (we have seen from multiple past projects in the area), to further reduce your risk and boost the upside on your investment.

- Earlier refinance opportunities (due to faster cash flow) are NOT included in the underwriting

- Rents are underwritten LOWER than what we expect

- Financing interest rate is underwritten HIGHER than what we expect

These are only a few examples, continuing the Boardwalk Wealth track record of under-promising and over-delivering.

Thanks for your continued vigilance and prudent management of our investments. You underwrite conservatively and are selective on the deals you choose to go in on.

Farzana P., Boardwalk Wealth Investor

The Sioux Falls Advantage

Lower unemployment rate than the national average

Thriving & diversified economy: healthcare, tech, retail, service

Higher average household income than national average

Housing demand far outpacing supply

Rising home prices & rents to due competition from buyers & renters

Our 4 existing developments in the area allow us insider knowledge plus economies of scale when it comes to property management contracts, maintenance fees, and the like

Minimal competition from existing product as well as constrained future supply as weaker developers have put their pencils down/stopped developing

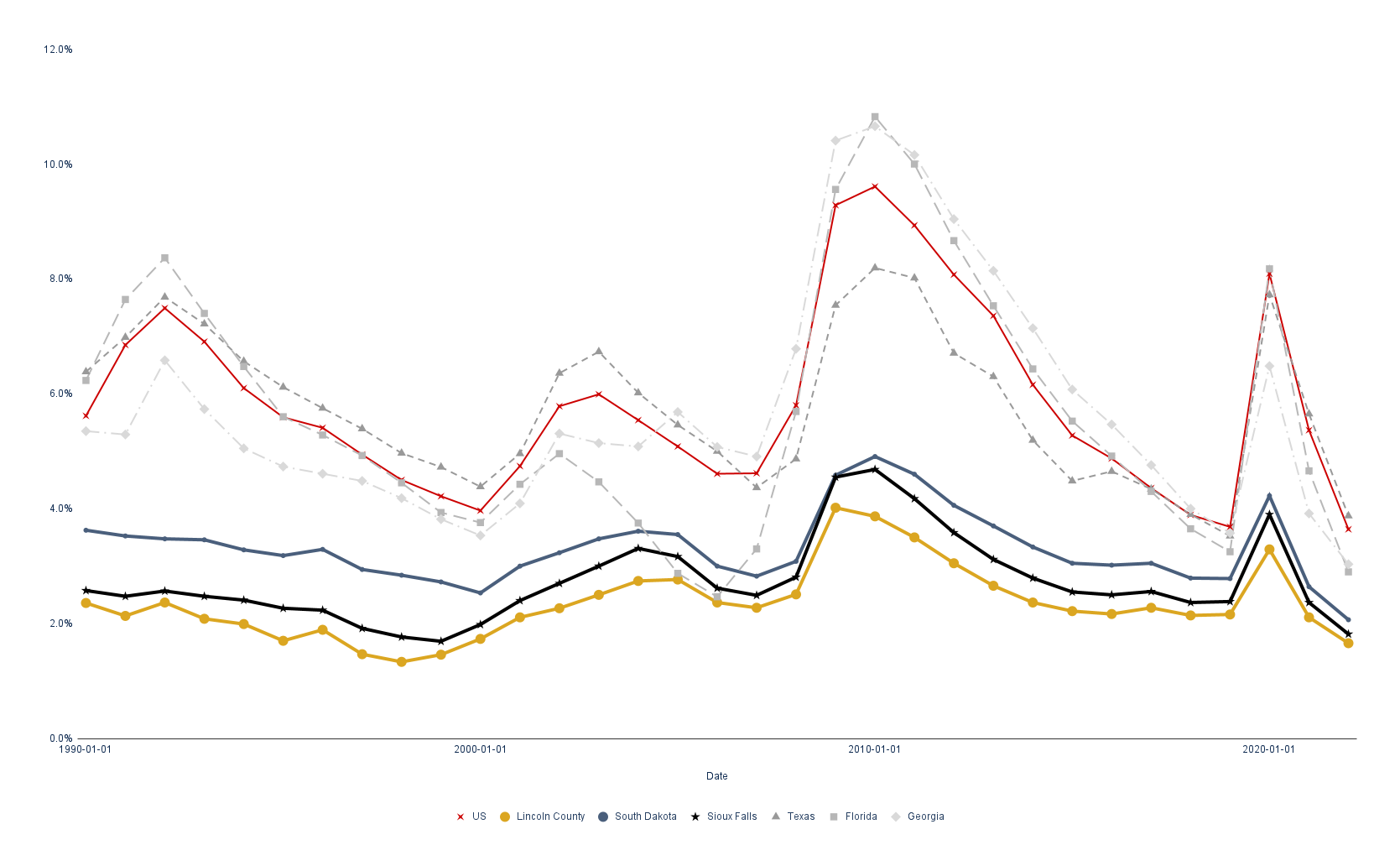

Unemployment Trend

Sioux Falls consistently maintains a lower long-term unemployment rate than the national average and major markets like Texas, Florida, and Georgia.

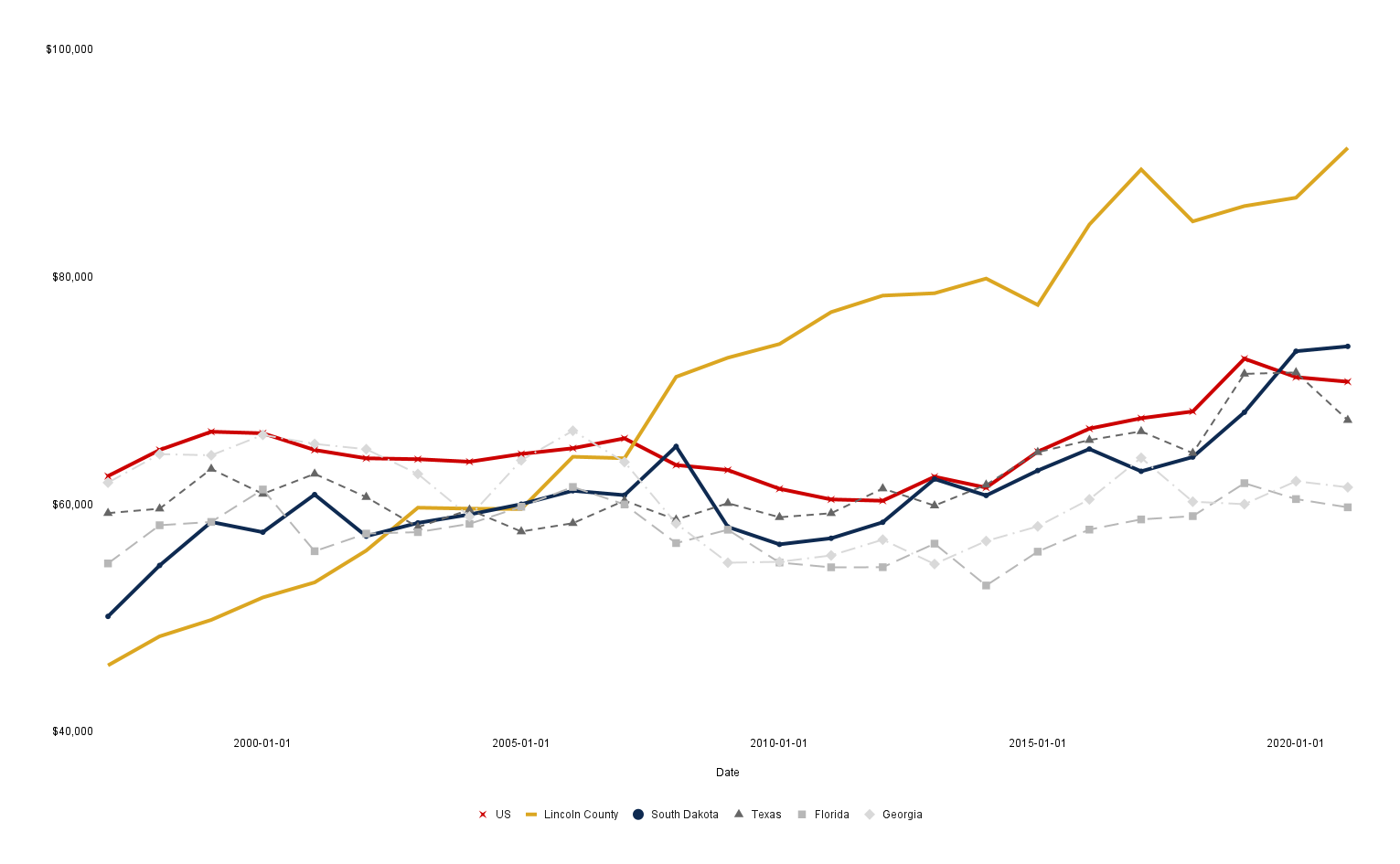

Household Income

Sioux Falls boasts a median income that surpasses both the U.S. national average and other prominent markets like Texas, Florida, and Georgia.

Maple Rock Reserve’s Hands-On Leadership Team

Omar Khan

Principal, Boardwalk Wealth

Dusten Hendrickson

CALEB VELDHOUSE

Construction, Veldhouse Companies

Strong work, Omar. You are one of the most transparent GPs I’ve had the pleasure of investing with!

Bimal S., Boardwalk Wealth Investor

FAQ

1. How did you get such extensive development experience & success in this market?

Dusten (lead developer) has been successfully operating in the local market for over a decade and has deep business, family and community ties in Sioux Falls.

Caleb (head of construction) is similar, operating a multi-generation family business.

We have two premium developments in Sioux Falls (Blu on Lorraine and The Velthuis) that have an amenity-rich design. Blu opened at the end of August 2023, and Velthuis is progressing on schedule — despite building during Covid, international supply chain breakdowns, and the fastest rising interest rate environment in US history.

In terms of the No Frills format, we have successfully executed this strategy on three other South Dakota developments: the Reserve Flats in Brookings, Washington Crossing in Sioux Falls, and Briarwood Reserve in Sioux Falls. We also just recently closed our Jefferson Reserve deal that follows the same model.

This approach builds faster, gets rents faster, and feeds the starving local demand for quality-yet-No-Frills Class A shelter.

2. Why develop in a rising interest-rate environment?

Rising rates have made it harder to qualify for a home loan. This comes on top of the existing housing shortage in the local market. Further, the higher interest rates have forced less qualified developers out of the market.

Our (successful) policy is to develop if inventory is needed, regardless of the rising or falling of interest rates. When the rates drop back down we refinance, because the price to construction is always cheaper today than tomorrow (with few exceptions).

We have 2 distinct advantages:

- Ability to secure debt at below-market terms due to our deep relationships with local banks.

- In-house development and construction team that helps us drive efficiencies throughout the development process.

This helps us to cater to the ravenous demand while being financially prudent. The lack of competing products provides additional leverage post-construction as we will be able to move rents and push occupancy quicker than underwritten.

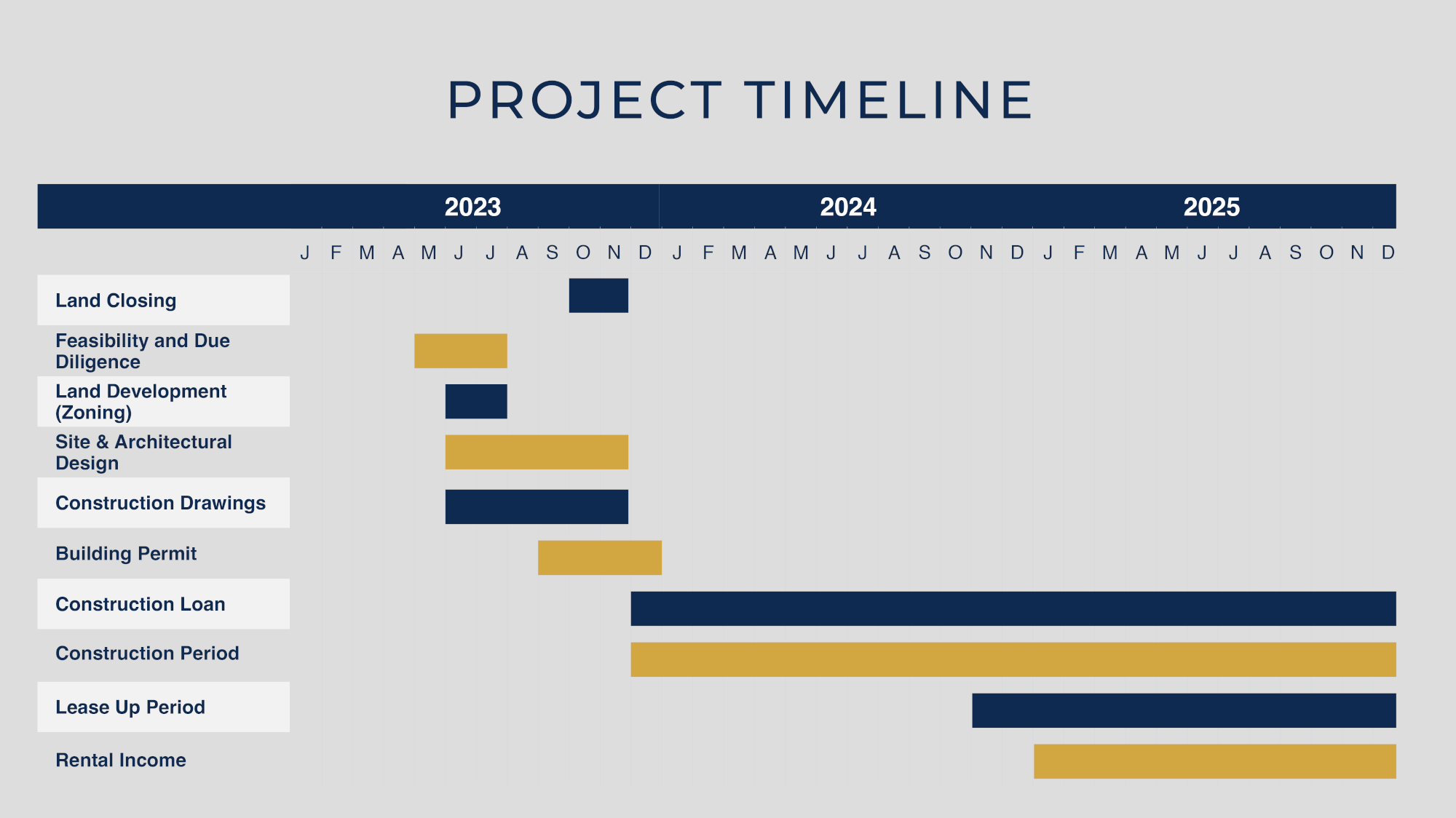

3. What is the construction plan?

Maple Rock Reserve will be a series of 11, 12-plex (12 units) buildings for a total of an expected 132 units. This quality but no-frills wellness design reduces construction costs and allows significant operating efficiencies pre- and post-construction.

Each 12-plex building will be built one after the other. This will allow us to lease units and have the property cash flowing during construction. The taxes and interest are typically paid for by this additional income, which leaves more in the reserve account and further reduces risk.

Upon the completion of each building, the cash flow stream will be seasoned earlier vs. the typical development where the entire development has to be constructed before cash flow begins. The earlier seasoning of cash flow allows for a potential earlier refinance (not included in the underwriting for conservatism). This would let us return funds back to investors at a quicker pace especially as the market expects rates to be lower heading into the latter half of 2024 / early 2025. To reiterate, a refinance is not modeled into our underwriting to maintain conservatism.

4. What is the exit strategy?

There is only one exit strategy in any real estate investment — sale. The unique, no-frills approach can allow for a quicker refinance due to income seasoning earlier.

We will position the asset for an eventual sale in case we are able to secure an above-market offer. This is especially important as the Sioux Falls market continues heating up due to the limited housing supply and favorable business climate.

5. Why Sioux Falls?

Favorable population growth and job growth along with supply-demand imbalances and an “under the syndication radar” baseline make Sioux Falls an obvious target for the savvy real estate investor.

Beyond that, our developments here keep working, coming in ahead of schedule, and we have tons of penetration and experience in this market — all “unfair” advantages that investors need to lean on.

I wish I could say we were so huge and impactful that doing 7 developments (with more to come) “saturates” the market but the fact is that it is woefully under-served for the present AND projected demand. And our projects will be but a drop in the bucket.

Of course, as the institutional capital moves in they will bid up prices so maybe in 5+ years we will pivot from new developments as we sell our current holdings at much greater values.

Now is the time to get in.

Watch our video about what makes the Sioux Falls market so special for in-the-know passive investors:

THE LAND IS ALREADY UNDER CONTRACT & SHOVEL READY!

Like all our developments, this project is Ready To Go once funding comes in. No waiting, no guessing; just an efficient and pre-prepared build process that gets to cash flow as soon as possible.

SOFT COMMIT TO THIS DEAL

(5% BONUS SHARES)

Register your interest now to increase your chance of being able to participate! Last-minute registrations may go on our backup list and may not receive bonus shares.

The reason I would consider this investment is because you are involved and you have a great track record on deals I have been involved in.

Brian M., Boardwalk Wealth Investor

This information does not constitute an offer or solicitation to purchase securities. An offer can only be made by the Private Placement Memorandum (PPM). The PPM and its exhibits have complete information about the Property and the investment opportunity. The information here is not a substitute for an investor’s complete review of all the information attached to the PPM as part of their own due diligence regarding this potential opportunity and its suitability for their investment portfolio.