Your passive multifamily investment relies heavily on the apartment vacancy rate.

That’s why your deal sponsor should be focused on optimizing overall revenue performance. Sometimes it’s important to cycle in new residents, while most other times the property management team strives to keep existing residents.

There are costs associated with each, and the successful real estate investor must know them.

What Is An Apartment Turnover?

When a lease expires and an existing renter leaves, we call that a “turnover”. The unit has to be made ready for a new resident.

Apartment turnovers are a normal part of managing a property. In US multifamily real estate, on average, 42% of the properties are going to turn over in a given year.

But during certain economic times — like mass uncertainty or recession — even average turnover rates can have a brutal effect on the bottom line.

An Occupancy Strategy During Down Markets

The boom time multifamily plan is typically quite simple: do basic value-add improvements and then rely on aggressive rent growth. Since there is general consumer confidence and exceptional demand, properties can maintain high occupancy (90%+) while still commanding top-of-market rents and cycling in new residents. It may be easier to convince a new resident of the value of their “new” apartment unit, as opposed to having an existing resident agree to a substantial raise in fees.

However, during down markets there is no more room for rents to go up.

In effect, you can’t get blood from a stone. Most renters simply cannot afford to pay any more.

Further, the desires and demands of residents materially change in down markets. Before they may have prioritized the pool/gym amenities or insisted on the latest style of kitchen backsplash, but now that becomes secondary to simply finding an affordable place to live.

In such times, the cost of losing an existing resident and having to find a new resident may outpace any rent growth wins.

So in order to maintain occupancy it becomes prudent to take steps to ensure maximum resident renewal. This is especially important when interest rates have recently increased, as steady occupancy is the prime defense against rising debt service costs.

Let’s compare turnover expenses with alternative costs to reduce vacancies.

Cost Of Turning A Multifamily Unit Versus Resident Retention

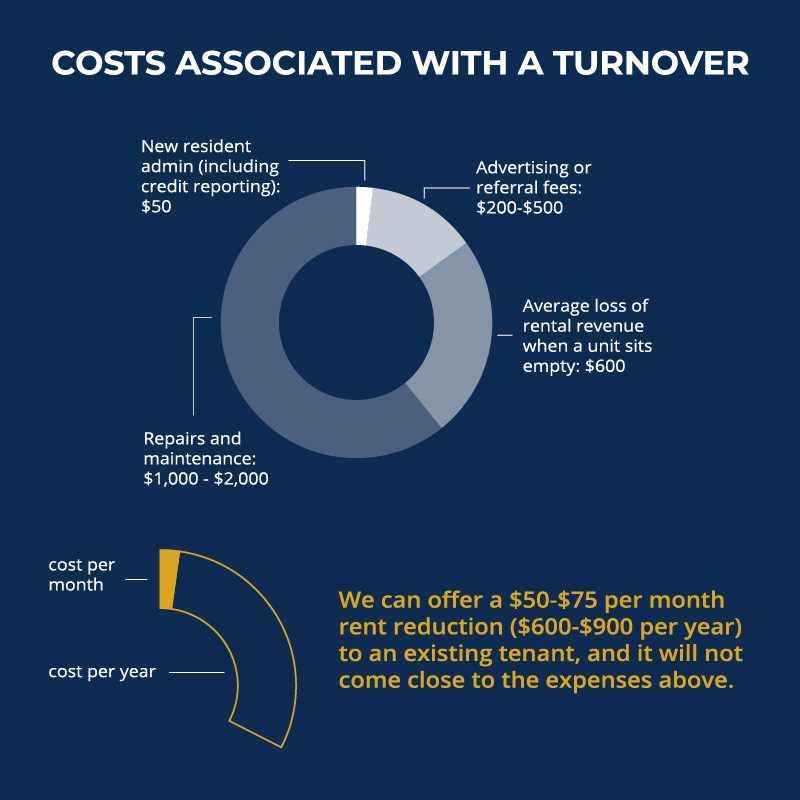

Here is a brief (non-exhaustive) list of some costs associated with a two-week turnover period at a typical Boardwalk Wealth property:

- Standard repairs and maintenance $1,000 – $2,000

- Average loss of rental revenue when a unit sits empty for half a month $600

- Advertising or referral fees $200-$500

- New resident administrative fees (eg. credit reporting) $50

Given the expenses involved, we would have to lower our rents over $150 (on the low end) to incur the same losses as an average turnover.

Now imagine a scenario where we have a renewal coming up.

If we offer a current (consistently paying, positive contributor to the community) resident a $50-$75 rent reduction, it is a no-brainer when you consider all the numbers we just discussed.

It may not be necessary to offer rent reduction, but that is a very impactful option to aid resident retention.

Knowing that we have this option — and it still allows us to come out ahead financially — gives us the operational flexibility to continue positively guiding the asset during an otherwise turbulent time.

More Resident Retention Strategies For Maximum Multifamily Occupancy

The intangible value of keeping an existing resident goes beyond just the savings of turnover costs.

The existing resident likely:

- pays on time (ie. no burden on collections)

- refers like-minded friends and family to the property

- has roots in the community and generally takes better care of their unit as well as the shared amenities

A prudently operated multifamily complex does not just weigh turnover costs versus rent reduction costs.

Resident retention is built upon the foundation of how the asset has been managed from the start.

Some key strategies for maximum occupancy include:

- Consistent communication, swift responses to resident requests, commitment to ongoing maintenance, and established feedback mechanisms (eg. surveys, reviews, etc).

- Meeting amenity expectations that match the market and rents being charged.

- Security and safety (this one sounds obvious but property managers need to feel empowered by the sponsor to understand this is a high priority).

- Transparent policies and fee structures.

- Community-building events and activities, along with friendly customer service that is positioned to “feel like home” (this means hiring and supporting excellent PM staff so their turnover is also limited).

The entire playbook has to be in place so that your asset is safeguarded during potentially shaky markets.

And, ultimately, that safeguarding can be summed up as Occupancy, Occupancy, Occupancy!