We are often asked how we pick the right deals amongst the hundreds that come across our desk. Doing a deep-dive analysis and underwriting on any more than a handful of deals a month is not realistic. A good part of this business is to not making stupid decisions as opposed to only taking smart ones.

By nature, we are a risk-averse and cautious group. The kind that measures twice but cuts once. Therefore, a filtering mechanism becomes essential to separate the wheat from the chaff. By having a defined investment criteria backed by thorough market research we are able to quickly filter through the noise to pick the right deals to deploy our capital.

So how do we do it?

Investment Criteria

This might be the hardest part of the entire filtering process as it requires big picture and granular analysis combined with an honest assessment of wants, needs and ability.

While most of us would like to acquire the nicest, fanciest property, our primary goal is to generate ample cash flow from our income-producing properties. Our M-O is to reposition quality, income-producing properties in solid neighborhoods with favorable demographics.

To accomplish this goal, Boardwalk’s investment criteria is:

- Value-add, B/C multifamily asset

- 100-200 units

- $15-20M

- 1975+ with pitched roofs

- 10-15% below-market rents

This was developed after much deliberation. At the 100-200 unit level, our competition is (somewhat) unsophisticated investors or syndicators with a shorter track record than ours. This helps us to avoid competing against institutional players.

This also gives us a competitive advantage as we can point to our track record of always closing on time and never re-trading a property when communicating with brokers and sellers. We are also very comfortable raising between $6-8M per deal which falls right into the ideal all-in equity amount for deals in the $15-20M range.

Picking a narrow niche and strictly adhering to it provides us a distinct leg up. Similarly, other investors should also look to do the same as it narrows one’s focus and helps provide a consistent story when communicating with brokers/sellers.

Market Research

Our earlier article on market research lays the groundwork for selecting the right real estate market. To focus our energies, we went a step further by picking our 2 favorite markets – Jacksonville and San Antonio.

Again, this is not a light decision to take as picking 2 markets means ignoring every other market (for the time being)!

We start our market research process by developing a market research spreadsheet where we listed the major factors including data sources that affect multifamily demand and supply. Apart from the basic: jobs, population and income growth, we look at:

- Components of population growth including migration patterns – in-state vs. out-of-state;

- Renters as a percentage of the population

- Affordability index

- Demand and supply

- State and municipality landlord and tenant laws

- Phase of the market cycle

This helps us compare multiple markets at the same time to quantitatively choose which market to focus our energies on.

We follow this up by doing old-school networking. This involves calling up everyone in our network and requesting them to connect us with their local network. It shocks us all the time at how many people know other people in different markets around the US and the world. Most locals are inclined to have a detailed conversation especially if an investor comes with a good reference and a clear reason for talking.

But this is still only the start.

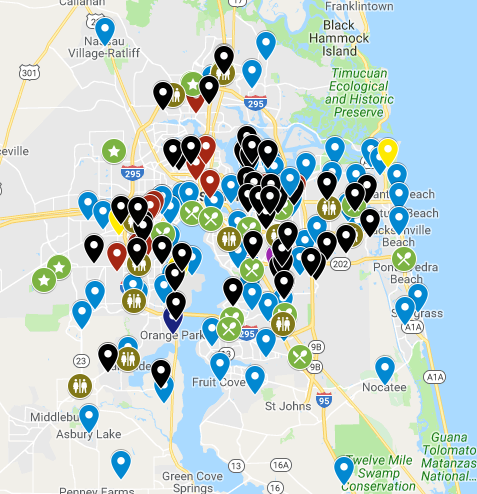

Post our initial market/economic research and networking, we start creating detailed maps. There are a ton of paid and free services available. We used Google Maps to get started and now use more specialized services from time to time.

This is a simple task (in theory) assuming an investor has done steps mentioned above. Essentially, we map all good, bad and upcoming areas including our reasons for classification.

We follow this up by adding layers like:

- Path of progress: Starbucks, Costco, Trader Joe’s, Sam’s Club, Walmart, IKEA, Amazon fulfillment centers and similar establishments

- High quality school: school that are rated 5 and above by websites like Great School

- Recent sales over the past 2 years: this information is available from industry databases, broker reports and internal research. Good examples include: CoStar, Yardi, REIS and ALN.

We are not striving for precision. Our goal is to better understand the dynamics and geographical layout of the market. Setting hard-and-fast rules – e.g. apartments must be within 3-miles of a Starbucks – are not applicable in all markets. Similarly, whereas proximity to good schools is not a big factor for most high-rise, condo dwellers, it is crucial for the renter we are targeting – stable job(s), ideally young family with 2 breadwinners.

The image below is an example of a fully populated map of Jacksonville with all the layers switched on.

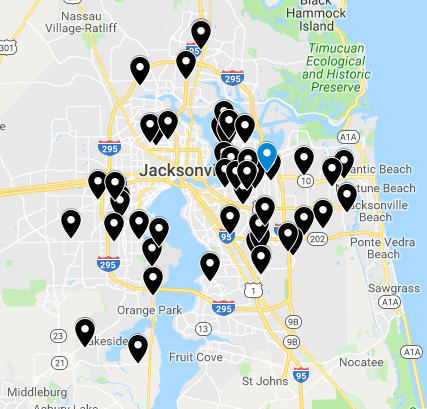

The same map with only the filter for areas where we don’t want to invest as indicated by our research.

The same map only showing sales since 2017.

As you can see from the above examples, simply turning layers on/off starts providing us with a better idea of about different parts of the city as well as helping us to virtually “walk” the neighborhoods from the comfort of our home. In combination with networking with local investors, brokers, PMs and other contacts, we are able to get a rich tapestry of information that be easily tapped.

This also has another big advantage. Whenever a broker talks about a property, we’re able to quickly understand the story merely by seeing where it is located on the map. This helps us in getting up to speed quickly while developing instant credibility with the brokers.

Everything mentioned so far is available online from free. Paid services can provide granular analysis but the average investor does not need this information starting out. We use a combination of paid and free resources as it cost effective and helps us avoid relying on one data source.

If deals do not pass this criteria, we do not even dig deeper into the financials. By ruthlessly filtering out, at each step of the way, we’re able to dramatically reduce the time it takes to underwrite deals.

This is the bulk of the heavy lifting that a passive investor needs to do in terms of quickly getting up to speed on the dynamics of the market and asset.

But we take this a step further.

The Next Steps – Digging Deeper

At Boardwalk Wealth, our deal-by-deal syndication model enables us to acquire attractive multifamily assets that we can hold for the long-term.

We are able to reposition our target assets – value-add, B/C, garden-style apartments – quickly and efficiently. The cash flows remain relatively stable even though valuations may swing wildly across the cycle.

We can choose the optimal time to refinance/exit because we have full control. Our proprietary models provide us detailed insight while maintaining conservative leverage and cash reserves to weather downturns.

We supplement the above activities by developing a business plan for each submarket that we operate in. E.g. to truly enjoy economies of scale especially around operational expenses, we calculated that we would need 300-500 units in the Southside and Arlington submarkets of Jacksonville.

This would allow us to concentrate our operational resources in a, relatively, constrained land area allowing us to drive down our cost structure dramatically. The same 300-500 unit spread across, say, 3 different markets would result in a very different cost structure which would not allow for the same economies of scale.

The process of underwriting starts after the initial screening stage. We are able to zero in on the key variables because of our experience in analyzing hundreds of deals in our target markets, subscriptions to industry databases and personal networks.

Now comes the time to decide the ideal capital stack.

We know some operators prefer to use a combination of mezzanine debt, bridge loans, preferred equity or other exotic variants. We prefer to keep our capital stack clean: agency debt and common equity. Sometimes, we can utilize bridge loans but only under particular circumstances with a clear path to exit or rolling into an agency product.

The simple capital stack helps focus our attention on the underlying operations of the assets as opposed to financial engineering. There is a time and place for everything but at this stage of the cycle (Oct 2018), we firmly believe that our existing portfolio of attractive multifamily assets are poised for compelling, long-term returns. Hence, our focus is 100% on operations.

Burdening deals with a complicated capital stack brings with it a whole host of risks that we either have no power to control (macro-economic) or no desire to manage (financial engineering) at this stage of the real estate and financial markets cycle.

The two big items we look at:

- Debt terms; and

- Project complexity

As of October 2018 for North Florida, agency debt is being quoted up to 75% LTV. But deals are facing significant hurdles meeting the DSCR and other constraints due to the high prices. Therefore, understanding the debt terms, give us a quick way to determine if a property can be easily financed. If not, we can look at non-agency options but only if the projects offer significant upside potential and with clear exit strategies.

Some groups tend to shy away from complex projects. But at this stage of the cycle, most of the attractive light value-add deals are gone. The solid deals that are coming across our desk have some level of operational and/or financial complexity.

These deal are either heavy value-add and/or repositioning plays which make them unsuitable for agency financing or require us to bail out existing owners out of a troubled deal. This is where we shine and find the true diamonds in the rough.

By leveraging our track record, expertise and relationships, we are able to look at these deals, often off-market, and get in either before the competitive bidding process starts or get to best and final bidding.

We can get favorable pricing by targeting some level of complexity: significant deferred maintenance, loan assumptions and/or affordability component. This is contrast to down the middle deals that neatly fit in the box of a large majority of invested. These deals are unlikely to trade off-market and have a competitive bidding process.

Our creative solutions are operationally driven because we are not overpaying for properties.

We believe that complex structures can pay off handsomely when things go well. But if things go badly, they are, usually, the first ones to face the axe.

Any deal that requires an exotic structure is riskier than one that doesn’t. Exotic structures do have their value and can be used aggressively when coming out of a downturn to take full advantage of the upswing in the cycle.

Our multi-step process allows us to eliminate deals that do not meet our strict criteria while preserving our time for the fat pitches – the home run deals. It is critical for investors to develop a similar filtering mechanism to avoid burning valuable time and energy chasing deals that go nowhere.

As you can infer from the above all of this sounds easy in theory. But it is very hard to continuously implement in real life. We have purposefully designed our team to ensure that we continuously refine our process and maintain discipline.

Having strong partners provides an additional layer of accountability as newbie and experienced investors alike can fall into the trap of making up the facts to suit the situation, consciously or unconsciously. In other words, we take active steps to avoid our emotional biases running amok.

In the culling phase, some good deals might be overlooked. But an overlooked deal is a million times better than a poorly chosen investment. We feel comfortable knowing a deal has survived our culling process, if and when a deal survives all the way though. It is an internal quality control check that helps us filter the wheat from the chaff.

The key is having a structure that allows us to overlook some stellar deals but limits our downside. Accepting lots of small “failures” is the only way to guarantee uncovering a few deals that end up being game-changers.

Initially, doing this level of work might take a little longer. Don’t worry. The idea is to implement a set of processes through which the investor can quickly filter out the plethora of deals that come across their desk.

As I’ve said multiple times, “No deal is better than a bad deal.”